Last Updated on October 23, 2020 by Guest

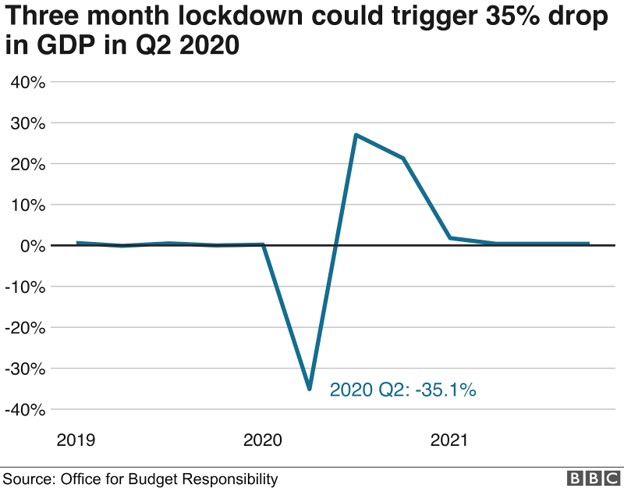

All startups and SMEs across industries need cash to lift their businesses into the exclusive sphere of successful companies. Finding investment capital to fund a startup business or grow a small enterprise can lead an entrepreneur in many different directions. A leader may choose to invest all their savings in their business idea and slowly expand using solely the revenue earned from the process of selling. Bootstrapping your way to the top can be incredibly rewarding but no less challenging. The perils that come with bootstrapping are multiplied in times of recession.

During times of economic downturn, entrepreneurs are faced with the daily challenges of inflation, increased taxes, high unemployment and other variables constituting a recession. It’s highly likely that the risks of using all available cash and savings on a business startup are too high to pursue.

Other sources of capital can come from family and friends, small business loans or crowdfunding. The implications of a recession on crowdfunding are twofold. First, it’s a cost-effective way to market your business in front of potentially thousands of people who are already interested in your business plan. Second; crowdfunding depends on a vast number of individuals parting way with their cash. Traditionally, individuals tend to save during a recession.

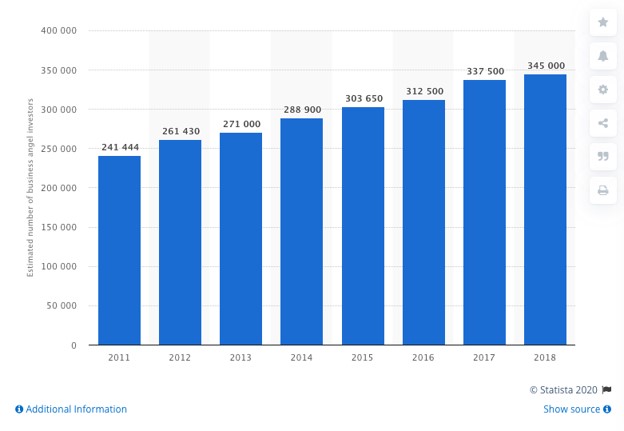

A more popular source of capital in the eyes of most entrepreneurs would be to team up with an experienced and wealthy individual; an investor. Angel investors have a habit of being extremely difficult to find in the best of times. They are, however, incredibly handy once found. Unlike their venture capitalist counterparts, angel investors are often more willing to back riskier projects– ideal in a recession.

As well as being high-net-worth individuals, angels can also provide invaluable levels of insight into endeavours and offer tangible advice for startups and SMEs. Similarly, it’s possible to pitch your business idea to Venture Capital firms to obtain a wealth of financial support, in return for a share of your companies equity.

As the notion of relinquishing ownership of your company can seem like a negative part of the VC deal, it certainly comes with some positive effects. Some of which, particularly useful during a recession. For example, you’ll find access to great levels of guidance from your VC firm and will definitely benefit from their expertise and industry contacts.

Now we’ve established that having an investor on board is a good way to bounce back after a recession, how can you find them and secure a deal?

5 Rules to Follow to Find an Investor in a Recession

1. Stay resilient

More so than ever before, when entering into a recession, the need to stay resilient in the face of adversity and challenges is crucial. Entrepreneurship is about far more than having a sound business idea. Rather, it’s about planning, execution and always having a backup plan.

Investors across the board are more interested in the person they are investing in, as opposed to the business. Granted, the business plan, model and probability for success is an important indicator in the eyes of an angel investor or venture capitalist firm. However, those entrepreneurs who are able to demonstrate commitment, self-motivation, restraint and perseverance will find it infinitely easier to attract high net-worth individuals, than those who cannot demonstrate these entrepreneurial characteristics.

All recessions take their toll on business operations. Demonstrate to your potential investor that you always have a backup plan and will never give up at the first hurdle. Saturate your investor with the confidence he or she needs to invest their time and energy into your business.

2. Network well

One of the best ways to find an investor at ant moment in time, but particularly in a recession is to network and make connections. Having your name and brand circulating in the exclusive club of investors will enable you to meet the right one. Either through word of mouth or by introducing yourself, make sure that you have a strong presence in the investor pool.

Networking events needn’t always include the participation of investors. Industry events are great ways to meet your competitors and potential partners. Find out who they’re working with and expand your awareness on how players in your market attract investors and how they keep them.

3. Manage your finances

Along with checking off all essential characteristics of a successful and resilient entrepreneur, investors will also be interested in your financial health. One of the main things investors look for when scanning the market for opportunities in a recession is the level of debt a company possesses as they enter a recession.

Chances are, most startups have already accumulated a fair amount of debt as they strive to kick their business off the ground in its early days. Under regular market conditions, this is expected and is of less importance to investors. However, entering into a recession carrying debt does not make for an attractive investment opportunity.

Strengthen your financial credibility by increasing your credit score, paying off debt, managing credit payments and cutting costs where necessary. An entrepreneur who is in control of their finances and who is able to make relevant adjustments to their expenditure is the type of person a high net worth individual could trust with their own capital.

4. Recession-proof your business

An obvious one, but no less important. Investors will be keen to know precisely how you plan to operate in the recession. Amidst the financial challenges, the economy will face, it’s imperative to have a plan in place to ensure minimal impact on your business. Here are a few things you can do.

- Grow your customer base

It’s difficult to overstate the importance of increasing the number of customers u have during a recession. Naturally, footfall, leads and conversions will fall- which is precisely why it’s important to do everything you an to retain your existing customers and welcome as many more as possible. The following point can lend to attracting more customers.

- Move to the online space

Cost-effective, relevant in a recession (particularly the one caused by the global health pandemic) and one of of the most meaningful spaces for marketers. Content really is king and it can help get your product or service in front of thousands more potential customers.

- Focus on your finances

Sound financial management is critical to ensure your company is ready to face a recession. Don’t hide behind inaccurate figures and don’t oversell your company. Entrepreneurs should be ready to understand, embrace and improve their accounts in order to move forward.

- Grow your product line

Typically, recessions generate new opportunities. Whether it’s budget variations of existing products and services or something new altogether. As we move toward a ‘new normal’, broadening your product line may be the key to surviving the next recession. Consider reallocating resources to an area in high demand. Think face coverings, working from home equipment and sanitation lines.

5. Know where to look

Despite being relatively difficult to find, both angel investors and willing venture capitalists reside in some fairly accessible places. The UK Business Angel Association (UKBAA) makes for a great tool on the matter. The UKBAA has stated that angel investors typically inject between £10,000 – £500,000 into a single business when funding them. Around £1.5 billion a year is typically invested domestically.

When it comes to Venture Capitalists, even in recessions, there are plenty of firms eagerly awaiting their next investment opportunity. Simply check out the A-Z Directory.