Last Updated on June 12, 2021 by Guest

In order to land in the 10% of startups that actually succeed, new businesses, from the conception of a business plan, to the building of a customer base, need capital funding to become profitable ventures in the long-term.

When considering funding options, startups will soon realize that cash can be found with angels, venture capital, or family and friends. Access to more funds can be realized by partnering with bigger companies too. Feeling self-sufficient? Try bootstrap your way to the top.

Regardless of which source of startup funding you find most appealing, one thing’s for certain – the Covid-19 Pandemic has changed the course of looking for and securing finance for your startup. Expectations at the start of 2020 for venture capital were high. Between 2018-2020 more than 25,000 global startups were funded annually through venture capital.

As the pandemic relentlessly and continuously threatens our economic health, economists, wealth managers, and investors are bracing themselves for the worst. In light of this crisis, venture capital funding for startups across Europe is set to take a significant hit.

With that said, there are a few ways to mitigate the threat imposed on businesses and shared around the world. The combination of innovative technologies, research and a possible change in business structure could help startups find funding during the pandemic.

1. Understand that deals will slow down

Reevaluate your expectations and align your startup capital needs with these newfound expectations. Many VC firms are taking their foot off the accelerator because of the effects of Covid – so much so that it has had an immediate impact on up to 7,000 startups per quarter. Startups across industries have been making multiple trips to the banks in an effort to stay afloat – including high valued unicorns.

It’s important for startup entrepreneurs to understand this steep decline in the investment market. They should expect a ‘new normal’ to include fewer rounds of funding, more syndicated deals, and definitely more cautious valuations.

Expecting delays, lower valuations, and fewer rounds of funding, startup entrepreneurs should be able to navigate the new normal strategically. They will be expected to prioritize growth strategies, consider more cost-effective marketing campaigns, and find ways to stay afloat until the deal comes in.

2. Look to the past

The global pandemic isn’t the first hit to the international economy and won’t be the last. We can learn from the past to find ways out of current crises. Despite world-class vaccination programs being rolled out globally, there’s still a long way to go. Thankfully, many VC firms are up for the challenge. With the benefit of hindsight, angel investors, VCs, and banks know all too well that many startups will thrive in the wake of the pandemic – and they’ll want to be a part of it.

Let us revisit the 2008 financial crash: A disastrous era for many businesses, with thousands forced to shut down. There were, however, some big winners. How did they do it, and should startups today, be following suit?

Companies then and now were advised by investors to plan for two years without raising new funding. Startups have no choice but to throw out previous business plans, reassess expenses, and risks.

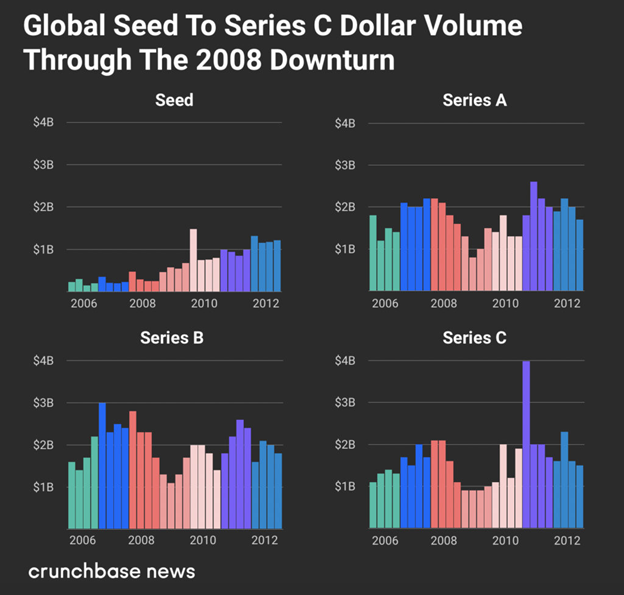

Crunchbase found that seed-rounds were the least affected of all early-stage rounds. In fact, seed dollars grew in 2008, 2009, and 2010. The assumption is that at the time, seed was a new institutional funding class due to the innovation in cloud computing. It was, therefore, cheaper to start a company – hence the growth of seed.

The funding environment changed significantly for Series A, B, and C rounds in 2009. In 2010 the funding market began to pick up again, but it wasn’t until 2011 for these funding rounds to amount to the volume of invested dollars in 2007.

The value of looking to the past is found by reflecting on historical data. In this case, the 2008 crash – largest since the Great Depression – took over two years for the funding market to pick up again. As advised over a decade ago, startups should plan for two years without additional capital by restructuring business models. This way, in the worst-case scenario of not finding funding, they have a plan in place until the market picks up again.

3. Do your research

You may have realized that the startup funding space may not be as active as it was this time last year. But investors, VC firms, and angel investors are still seeking investment opportunities that will grow their wealth. Entrepreneurs should be looking into which investors are most likely to invest in their industry, and shortlist their names and details.

Research at this stage should include assessing investors’ most recent investments to gain critical insight into whether they are likely to invest in your startup. This could include the scale of the businesses they back, their active involvement, and average deal size.

Use this data to hone in on the prospective investors that are best suited to support your venture. Having this information can give you an edge over competitors who are likely to be eyeing the same capital in this climate.

4. Reassess your business model

With research out of the way, you’ll be well-prepared to reassess the viability of your business model in the current environment. Keep in mind what the consumer world will look like in the wake of the pandemic and ask yourself, is my business still profitable? Is it scalable? Is it sustainable in the long-run?

If the answer to these questions is no, you’ll need to make some changes to demonstrate to potential investors that there is a demand for your goods or services. Remember that the pandemic has changed consumer behavior drastically. They’ve become particularly more concerned about prices and are on the lookout for value. Investors will be keen to see that you have taken this change in consumer behavior into consideration.

5. Polish up your remote contact

Take a look at your messaging to investors. Yes, it can be improved. It’s no secret that investors are more likely to financially support businesses with a strong USP. You have to ensure that your pitch reflects the same. Whether your focus point is product innovation, a problem you are seeking to address, or answers you want to give to the world; your startup should first and foremost, stand out from the crowd.

With that said, you’ll probably find yourself upselling your company – and so you should. However, when it comes to valuations, be open to negotiations. As we continue to walk hopelessly into more economic uncertainty, kickstarting your deal with an extremely high valuation will put investors off. Be realistic and achievable to gain their trust and appreciation.

Remote relationships can be challenging to form and nurture. VCs have openly said that they’re open to startups reaching out to them online – but do foresee challenges in building long-term partnerships. Overcome these challenges by making your first contact through an introduction, followed by making your pitch submission eye-catching to combat screen fatigue.

6. Turn to tech

The tech industry has historically been able to preserve itself and even thrive during economic crises. So, VC’s and angel investors naturally turn to technology, and R&D. Data collected for a Crunchbase analysis revealed that investors are particularly looking for technology providing social impact. Indeed, 4impact and Blossom capital are setting up new funds to support high-potential startups with impactful solutions to the coronavirus pandemic.

From the future of the workplace to online health care, these are the areas warranting the most investor attention. Regardless of the startup industry, service, or goods provided, it’s always advantageous to explore technological options that could be implemented into the business going forward.

It’s not only institutional investors who are looking for impactful businesses. The European Commission launched the Innovation Fund in 2020 to boost growth and competitiveness for European companies. With that said, a tech transfer is vital to building financially stable businesses in the future.

7. Consider bridge rounds

Think very carefully about how much capital your startup actually needs. With all the uncertainty in the air right now, a bridging round – or lower valuation – might be more suitable for your startup.

A bridge round is essentially a small round of funding to help get a startup through a certain period of time until its next larger funding round. This round of funding can be implemented at any startup stage and is a good way to access just about the right amount of capital easily.

The benefits include solidifying a startup’s short-term position – until a longer-term round is relevant. So, simply rethink the amount you’re asking for before reaching out to an investor. And remember that working capital is more important than maintaining a valuation that can always go back up when the market returns to a healthier state in the long-run.