Last Updated on October 27, 2021 by Guest

The recently concluded CoinGeek Conference, held at The Sheraton Times Square Hotel in New York from October 5 to 7, 2021, has given the world of digital currencies a real treat by inviting the fathers of the concept of blockchain, W. Scott Stornetta, and Stuart Haber, to a panel discussion to talk about how they came about inventing digital timestamping in 1991.

The panel includes Bitcoin white paper author Dr. Craig S. Wright. They penned the unprecedented publication under Satoshi Nakamoto’s pseudonym and financial cryptographer and creator of the Ricardian contract Ian Grigg.

The idea of digital timestamping was born from Stornetta’s obsession with providing integrity to records without being dependent on a single authoritative figure or entity. Together with Haber as a co-author, he published three papers about digital timestamping and created patents that earned them the 1992 Discover Award for Computer Software.

“I realize that everything is going to be in digital form, and there’s going to be no way to tell an authentic or original document or record from something that was modified just milliseconds before it popped up on your screen. And I thought this was not going to be good. We needed a world where we could trust the record without having to trust an authoritative figure. And that’s what I was obsessing [about],” Stornetta explained.

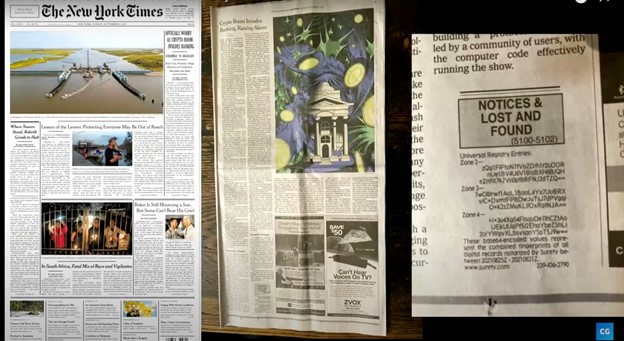

Stornetta and Haber later co-founded Surety Technologies that became the pioneer in digital timestamping services. One of the more exciting parts of the discussion is that Stornetta and Haber have continuously published ads in The New York Times that contain the hash value of all of Surety’s registration requests since 1991.

Haber even brought with him a copy of the September 5, 2021 edition of The New York Times with the headline “Officials Worry as Crypto Boom Invades Banking” to show how they continue the process to this day.

“But I first want to grab the delicious irony of The New York Times trying to warn the world that crypto is coming. And then to find at the bottom of the article, something that essentially asserts, ‘Yeah, been here for 30 years. Nice that you started to notice us,'” Stornetta wittingly pointed out.

“If you imagine a pre-Internet, dial-up modem, AOL world, the idea is placing in all of the major libraries of the world a weekly copy of a record. The difficulty of launching, if you will, a 51% attack on all of those records throughout the world is enormous. And that’s why I can sleep at night,” Stornetta replied when asked why they continue to do place ads in The New York Times.

And this is also the basic concept of security for Bitcoin and why scaling is a non-issue for the original Bitcoin, the first-ever functional application built on blockchain.

“The way Bitcoin was designed to work is that the hash header, not the whole block, was meant to be disseminated widely. Now, everyone runs around going, ‘I have to download a block,’ which is completely wrong. You don’t have to download everything you guys have, and you only need the little header—that little bit that they keep publishing,” Wright explained.

“So, you publish this little teeny-weeny bit every 10 minutes, and that completely, utterly secures the network. Because if that isn’t secure, nothing is. And that’s the whole bit everyone keeps forgetting. They keep going, ‘Oh, you can’t have big blocks because there’s too much information to send to everyone in the world.’ Well, you don’t send it to everyone in the world, just like they haven’t filled the whole newspaper up with everything that they’re doing,” Wright added.

Evidence of this fact that Wright frustratingly points out is how BSV has unlocked unlimited scaling, how a 2GB block has recently been mined on the BSV blockchain, how throughput will be increased to over 50,000 transactions per second (tps), and how nearly 500 companies are currently building and have already made working applications and platforms on it.

This is the true vision of Bitcoin and blockchain—for everyone everywhere to use it for everything—not just payments, but all forms of records and data.

“Because Scott and I were concerned not exclusively with financial records, but records of all kinds, I always saw the blockchain as a mechanism for the integrity of records as being important for anything that requires records—that’s all of civilization if I’m a little grandiose about it,” Haber stated.