Last Updated on November 21, 2021 by Guest

Running a small business isn’t cheap. If you’re a new startup, it can take you years before seeing a profit. Payroll, rent, supplies, utilities—these are just some of the big-ticket items you need to pay for that can cost your business a lot of money.

However, thanks to Uncle Sam, there are plenty of ways you can reduce your tax bill as a small business owner. Whether you run a mom-and-pop shop or own a small service company, it’s essential to know the different ways you can save money throughout the year. Take a look at standard tax deductions that are available to small business owners below.

1. Insurance

As a business owner, it’s wise to get business insurance to ensure your business assets and property are protected in the event of theft, damage, liability claims, and so forth. However, paying your monthly insurance premium can take away from the profits you earn throughout the year. Fortunately, the IRS allows you to deduct premiums you pay on business insurance for a variety of claims, such as:

- Workers compensation

- Employee benefits like health, vision, and dental insurance

- Liability coverage

- Property coverage for business assets like furniture and equipment

- Employee life insurance

- Auto insurance for company vehicles

When it comes to claiming deductions on your business tax return for the year, you must have the proper documentation to prove you’re not scamming the IRS, or else you might end up with a tax agent knocking on your door. To ensure you comply with federal, state, and local tax laws, prepare your returns with professional tax software that can itemize and keep track of your deductions.

2. Depreciation

If you’ve ever bought a new car from a car dealer, you probably know a lot about depreciation. We’ve all heard that the moment you drive a car off the lot, it loses its value instantly. While you can’t deduct depreciation from personal assets under the guise of your business, you can deduct depreciation from expensive business purchases. Some everyday purchases that have high depreciation values include:

- Heavy machinery and equipment

- Furniture and technology

- Appliances

- Business assets

Expensive items like these can cost a lot of money upfront and lose money over time. By deducting the depreciation of these pricey assets, you can save yourself money even with this loss.

3. Home Office Expenses

Depending on your line of work, you might not even need to work in an office. Telecommuting and freelancing are becoming more and more popular, and the gig economy is expected to continue to grow in the future. That said, many contractors, freelancers, and remote workers need their own home office. If you have your own home office for your business, you can deduct part of the expenses as business expenses. However, you must be careful in doing so. The IRS is extremely serious about keeping business expenses and personal expenses separated. If it’s found any portion of your home office is used for personal reasons, you may land in troubled waters with Uncle Sam.

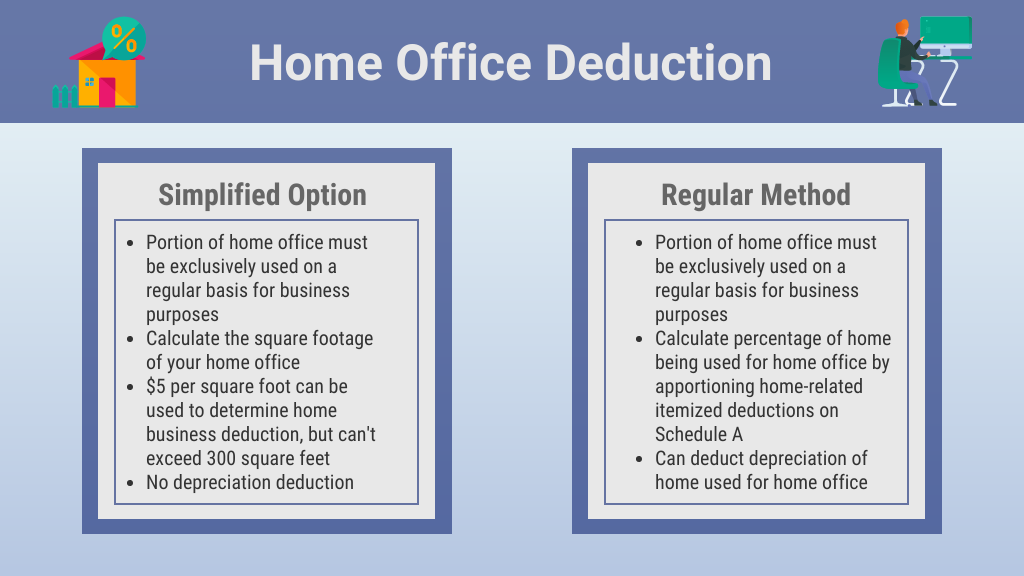

When it comes to deducting home office expenses, you can go one of two ways:

- Square footage: A simplified method is by deducting $5 per square foot, up to 300 square feet, for a home office that is used strictly for business.

- Percentage of use: The standard method is by taking your mortgage interest or rent, utilities, housekeeping, property taxes, landscaping, HOA fees, and repairs, and multiplying it by the percentage of your home that is used for your home office.

For your home office deductions to qualify, your home office must be the principal place of business, meaning most business activities take place in your home office, and your home office must have regular and exclusive use, which means your home office can’t also serve as your dining room.

4. Travel and Meal Expenses

A great way to build company culture and win over clients is by providing meals on the company card. However, this can be reasonably expensive. One way to save money is by deducting meal expenses. Typically, you can deduct 50 percent of qualifying meal and beverage costs and up to 100 percent for meals provided for office parties and similar gatherings. However, these meals:

- Cannot be lavish or extravagant

- Must have the business owner or employee present at the meal

- Must be a regular part of carrying out business

Along with deducting meals, you can also deduct travel expenses, such as:

- Plane, train, rental car, and other transportation fees

- Hotel and lodging costs

- Parking

- Meals and tips

- Ordinary expenses related to traveling

If you’re worried about the cost of meeting clients and trying to attract new leads, you don’t have to. You can deduct costly travel, transportation, and lodging fees from your tax bill.

5. Company Vehicles

Depending on your line of business, you may require company cars. Whether you have a fleet of vehicles or a few salespeople traveling the road, you can deduct the business use of a vehicle. When it comes to deducting the business vehicle, you must clearly distinguish between business use and personal use. If your car is used solely for business purposes, you can deduct the entire vehicle and related costs. However, if you use your car for both business and personal reasons, you will have to map out vehicle expenses for each category, such as gas, insurance, repairs, and so forth.

Wrapping Up

There are two constants in life: death and taxes. While tax season can be a significant headache for many small business owners, it can end up working out in your favor. The federal government has a variety of tax deductions small businesses can take advantage of to save money throughout the year. With most of these deductions, it’s essential to ensure they’re for business purposes only.

While these five small business tax deductions merely scratch the surface, there are plenty of other deductions that may apply to you, such as rent, interest, education, salaries and benefits, telephone and internet expenses, and moving expenses. To ensure you get the most bang for your buck, work with a professional tax expert who can help you qualify for as many tax deductions as possible.

Contributor: Samantha Rupp holds a Bachelor of Science in Business Administration and manages 365businesstips.com. She lives in San Diego, California, and enjoys spending time on the beach, reading current industry trends, and traveling.