Last Updated on December 4, 2012 by New-Startups Team

WalletMap, the expense tracking application, aims to change your expense management and help you understand where your money goes.

The premise is simple – whenever you buy something, enter it on your mobile app (currently available for iPhone and Windows Phone). Enter the category of your purchase – clothes, transportation, food, etc. Go to the website and bask in the greatness of knowing where you spend your hard-earned money.

What sets this app apart from the rest is the automatic categorization of your expenses. The smart app remembers where you shop, and with time, is learns to automatically categorize your purchases without needing your manual categorization. This is where the map/GPS aspect of the app comes into play.

For example, if you always buy your metro cards from the same kiosk, WalletMap will remember that specific location, and attribute future purchases to the transportation category.

And if you don’t see your category, no sweat, you can create your own!

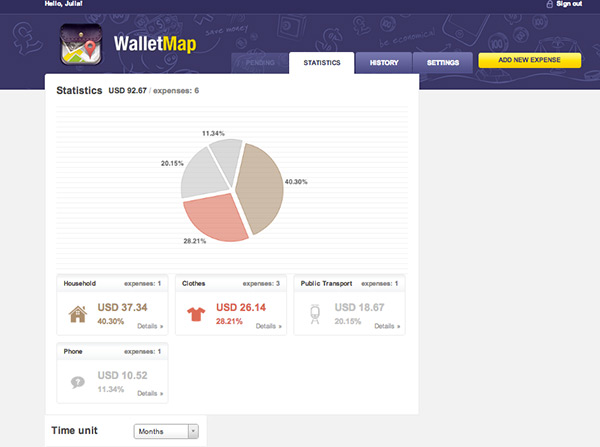

The mobile app only serves the purpose of entering the details of your purchases. If you want to get insight on your spending habits, then you’ll have to log into your account on the website. It shows you your payment history, and basic graphs on the division of your expenses. Though this is helpful information, the app could be taken to the next level if it included a wider array of analytics, such as being able to set budgets for the entire month or for separate categories.

This app sets itself apart from bank budget management solutions because WalletMap allows you to enter cash transactions. It bridges the gap between manual entries in big spreadsheets, and bank systems (which only track your card transactions). The only minus? It’s a lot of manual work. We’ll be able to see automatic expense management only when NFC is implemented into our daily payment systems. (keep dreaming!)